Personal Bank Loan Philippines 2025

Filipinos face all kinds of financial hurdles—from sudden medical bills to tuition deadlines or even the dream of starting a small business. When savings aren’t enough, a personal loan in the Philippines can be a practical solution. Thankfully, major banks like BDO, BPI, Metrobank, Security Bank, and UnionBank now offer more flexible and convenient loan options than ever before.

But which one should you choose? In this article, we break down the pros, cons, and everything in between to help you make an informed decision. If you’re considering a personal loan this 2025, here’s what you need to know.

What is a Personal Loan?

A personal loan is an unsecured type of loan, which means you don’t need collateral (like a house or car) to borrow money. Filipino borrowers commonly use personal loans for:

- Medical emergencies

- Education and tuition

- Travel or vacation

- Small business capital

- Debt consolidation

- Home improvement

Who Can Apply for a Personal Loan?

Personal loans are designed to be accessible, but banks still have strict qualifications. Generally, you’re eligible if:

- You are a Filipino citizen or permanent resident

- You are aged 21–65 at the time of loan maturity

- You’re employed (with at least 1-2 years tenure), self-employed (with stable income), or an OFW

- You meet the minimum monthly income (usually ₱15,000–₱30,000)

Each bank has its own set of requirements, so it’s important to check with them before applying. Some are stricter than others—especially when it comes to credit history.

Top Banks Offering Personal Loans in the Philippines (2025)

1. BDO Unibank Personal Loan

BDO’s personal loan is a popular choice due to its wide availability and high approval rates, especially for existing account holders. The process is fairly straightforward, though not the fastest in terms of release.

Loan Amount: ₱10,000 to ₱1,000,000

Interest Rate: Starts at 1.25% per month

Terms: 6 to 36 months

Processing Time: 3 to 5 working days

Honest take: If you already bank with BDO and don’t mind waiting a few days, this is a solid, no-fuss option. Just don’t expect lightning-fast processing or app-based disbursement.

2. BPI Personal Loan

BPI is known for offering one of the lowest interest rates in the market. However, their application process can be a bit more document-heavy, and approval may take a few extra days.

Loan Amount: ₱20,000 to ₱2,000,000

Interest Rate: As low as 1.2% monthly

Terms: Up to 36 months

Processing Time: 5–7 business days

Honest take: Best for those who want low interest and are willing to wait. If you’re after affordability and transparency, BPI hits the mark—but don’t expect same-day approval.

3. Metrobank Personal Loan

Metrobank takes a traditional approach—more paperwork, but a solid reputation and customer service to back it up. Great for conservative borrowers who value bank credibility over speed.

Loan Amount: ₱20,000 to ₱1,000,000

Interest Rate: Starts at 1.25% monthly

Terms: 12 to 36 months

Processing Time: 5 to 7 days

Honest take: Metrobank is best if you prefer face-to-face banking. It’s not the fastest or flashiest option, but the terms are fair, and they rarely hit you with hidden fees.

4. Security Bank Personal Loan

Security Bank is widely known for its fast processing time and relatively lenient approval. If you’re employed and meet the income threshold, approval can happen in just a few days.

Loan Amount: ₱30,000 to ₱2,000,000

Interest Rate: 1.39% per month

Terms: 12 to 36 months

Processing Time: As fast as 5 days

Honest take: Great if you’re in a hurry. While the interest is slightly higher than others, the speed and simplicity make up for it. Just make sure your documents are complete.

5. UnionBank Personal Loan

If you want a 100% online experience, UnionBank leads the pack. You can apply, get approved, and receive the funds—all without stepping into a branch.

Loan Amount: ₱20,000 to ₱1,000,000

Interest Rate: From 1.29% monthly

Terms: 12, 24, 36 months

Processing Time: Within 5 days (online)

Honest take: Ideal for freelancers and young professionals. The app is user-friendly, and the process is fast. Just be aware that strict verification steps may delay your first loan.

Loan Requirements & Step-by-Step Process

- Choose your preferred bank based on interest and terms

- Gather required documents: valid ID, income proof, utility bill, COE (if employed)

- Apply via website, app, or visit a branch

- Wait for approval (usually within 3–7 days)

- Sign contract and receive funds via bank account

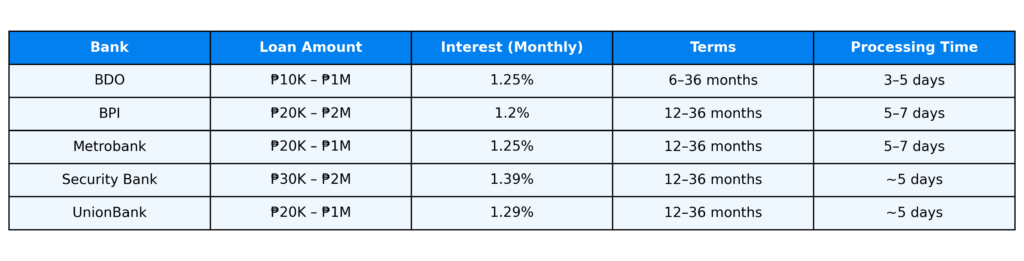

Interest Rates & Comparison Table

Tips to Get Approved Faster

- Check if you meet the income and employment requirements first

- Ensure all documents are complete and updated

- Avoid multiple applications at the same time—it can hurt your credit score

- Stick with banks you already have a relationship with

Pros and Cons of Personal Loans

- Pros: No collateral, fast processing, fixed terms

- Cons: Higher interest rates than secured loans, strict eligibility

My Final Thoughts

A personal loan in the Philippines can be a lifesaver—but only if you choose the right lender. Evaluate your income, compare rates, and never borrow more than you can repay. The five banks we reviewed offer solid, reliable loan products. Just be honest about what works best for your financial reality.